The goal is to minimise the amount of receivables that are old, particularly those invoices that are over 60 days old. Being proactive about collecting payments is a key part of accounts receivable management. Start by providing clear communication channels for customers to ask questions about invoices or payments.

Here we’ll go over how accounts receivable works, how it’s different from accounts payable, and how properly managing your accounts receivable can get you paid faster. Further analysis would include assessing days sales outstanding (DSO), which measures the average number of days that it takes a company to collect payments after a sale has been made. Accounts receivable are an important element in fundamental analysis, a common method investors use to determine the value of a company and its securities.

- Too often invoices don’t use the best available payment terms from the sales order, master data or historic invoices.

- Within the broader business process landscape, AR is the final step in the Lead-to-Cash process coming after Lead-to-Opportunity, Opportunity Management, Quote-to-Order, and Order Management.

- The Accounts Receivable process often involves a range of manual tasks, those manual actions both create costs and decrease collector effectiveness.

- The allowance for doubtful accounts is a more complex method used to post bad debt expenses.

Create documents for terms and conditions

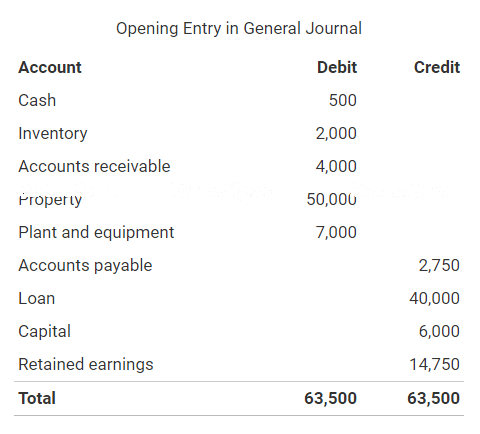

However, it is equally critical for each team to support the other in these processes. Every business should maintain a written procedures manual for the accounting system, and the manual should include specific procedures for managing accounts receivable. A procedures manual ensures that routine tasks are completed in the same manner each time, and the manual allows your staff to train new workers effectively and effortlessly. Net credit sales means that all returned items are removed from installment sales accounting method the sales total. An average accounts receivable is the (beginning balance + ending balance)/2.

Some firms charge late fees after a specific due date, and include the terms of the fee on each invoice. You can use a number of strategies to increase cash collections and reduce your receivable balance. Current asset less current liabilities equals working capital, and every business needs to generate enough in current assets to pay current liabilities.

Implement credit rules

Offering them a discount for paying their invoices early—2% off if you pay within 15 days, for example—can get you paid faster and decrease your customer’s costs. nonprofit business loans If you don’t already charge a late fee for past due payments, it may be time to consider adding one. For comparison, in the fourth quarter of 2021 Apple Inc. had a turnover ratio of 13.2.

Accounting software with built-in features for accepting digital payments, like QuickBooks Online, makes it easier to manage accounts receivables. Fundamental analysts often evaluate accounts receivable in the context of turnover, also known as the accounts what is a trial balance report receivable turnover ratio. By monitoring this payout frequency, you can better manage how efficiently your business is collecting revenue—the higher the value, the more productive your A/R processes likely are. Keeping your finances on track and staying on top of your accounts receivable (AR) is important for healthy cash flow in a small business. Effective accounts receivable management involves managing and tracking outstanding customer invoices and ensuring timely payment collection. Poor management of accounts receivables refers to the various operation and financial issues of business that impact the receivables management efficiency .

Collection agencies often take a huge cut of the collectible amount—sometimes as much as 50 percent—and are usually only worth hiring to recover large unpaid bills. Coming to some kind of agreement with the customer is almost always the less time-consuming, less expensive option. If you have a good relationship with the late-paying customer, you might consider converting their account receivable into a long-term note. In this situation, you replace the account receivable on your books with a loan that is due in more than 12 months and which you charge the customer interest for. Many companies will stop delivering services or goods to a customer if they have bills that are more than 120, 90, or even 60 days due. Cutting a customer off in this way can signal that you’re serious about getting paid.

How do you manage account receivables effectively?

When it becomes clear that a receivable won’t be paid by the customer, it has to be written off as a bad debt expense or a one-time charge. Companies might also sell this outstanding debt to a third party debt collector for a fraction of the original amount—creating what accountants refer to to as accounts receivable discounted. Furthermore, accounts receivable are classified as current assets, because the account balance is expected from the debtor in one year or less. Other current assets on a company’s books might include cash and cash equivalents, inventory, and readily marketable securities.

A roundup of some of the best accounting software solutions for consultants. The IRS’s Business Expenses guide provides detailed information about which kinds of bad debt you can write off on your taxes. Accounts payable on the other hand are a liability account, representing money that you owe another business. A quick glance at this schedule can tell us who’s on track to pay within 30 days, who’s behind schedule, and who’s really behind.